The giants have joined forces. Reliance’s Jio Financial Services and BlackRock – the world’s largest asset manager with $10 trillion in assets – have launched a mutual fund venture set to redefine India’s investment ecosystem. Their maiden offering, the Jio BlackRock Liquid Fund, opens for subscription on June 30, 2025, marking a seismic shift in how Indians access wealth creation. This isn’t just another New Fund Offer (NFO); it’s a tech-powered gateway to global investment expertise tailored for India’s digital masses.

1. The Jio-BlackRock Partnership: Why It’s a Landmark

In 2023, Jio Financial Services and BlackRock announced a $300 million joint venture, securing SEBI approval in early 2025. This collaboration fuses BlackRock’s global investment prowess with Jio’s unrivalled digital reach (450M+ users). Key objectives:

- Democratize access to low-cost, institutional-grade funds

- Leverage AI-driven platforms for personalized investing

- Target India’s underpenetrated mutual fund market (MF AUM-to-GDP ratio: 15% vs. 70% in the US)

Expert Insight: “This partnership could disrupt India’s AMC industry. BlackRock’s tech stack (Aladdin) combined with Jio’s distribution might reduce costs by 30-40%.” – Moneycontrol AMC Analysis

2. Jio BlackRock Liquid Fund: Your First Opportunity

Key NFO Details (Live June 30 – July 14, 2025):

| Feature | Detail |

|---|---|

| Min. Investment | ₹500 & multiples thereafter |

| Risk Profile | Low (Ideal for conservative investors) |

| Exit Load | Nil |

| Benchmark | CRISIL Liquid Debt Index |

How It Works: This fund invests in ultra-short-term debt instruments (commercial papers, treasury bills) with maturities under 91 days. Expect higher returns than savings accounts (historically 6-7% post-tax) with instant redemption.

Who Should Invest?

- Emergency fund builders

- Conservative investors shifting from FDs

- Businesses parking surplus cash

3. 5 Unbeatable Advantages of Jio BlackRock Funds

- Cost Efficiency: Expect expense ratios 20% lower than industry averages (target: 0.2% for direct plans)

- Digital-First Onboarding: Paperless KYC via Jio’s app, UPI integration

- Global + Local Insights: BlackRock’s macro-analysis + Jio’s hyperlocal data on Indian consumption

- Liquidity: Redeem within 24 hours (T+1 settlement)

- Safety: AAA-rated instruments only; SEBI-regulated

4. How to Invest in 4 Steps (Screenshots Coming!)

- Complete KYC: Update PAN/Aadhaar on SEBI’s KRA portal

- Access Platform: Via Jio Financial Services app, Upstox, or Angel One

- Select Fund: Navigate to “Jio BlackRock Liquid Fund – NFO”

- Invest: Choose amount (₹500+), pay via UPI/Bank transfer

Pro Tip: Allotment is first-come-first-serve. Set reminders for June 30!

5. Risks & Precautions: Don’t Skip This!

While liquid funds are low-risk, consider:

- Interest Rate Risk: Rising rates can marginally impact NAV

- Credit Risk: Defaults in underlying securities (mitigated by AAA-only mandate)

- Inflation Risk: Returns may lag inflation in high-growth cycles

Always: Read the Scheme Information Document (SID) before investing.

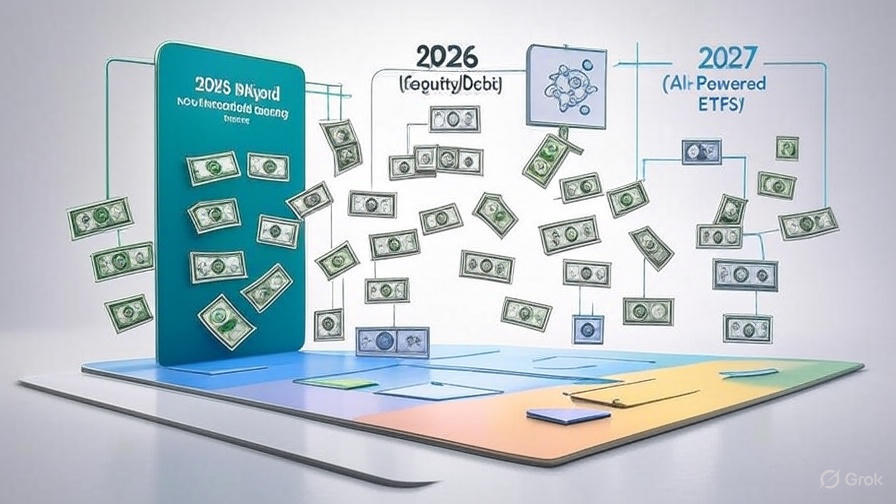

6. The Future: Beyond the Liquid Fund

SEBI has greenlit Jio BlackRock’s full-fledged AMC license, hinting at:

- Digital India Equity Fund (tech-focused stocks)

- Green Energy Portfolio (aligning with Reliance’s renewables push)

- Aladdin-Powered Robo-Advisor – AI-driven portfolio management

As Angel One reports, this could capture 5% of India’s MF market by 2030.

7. Why This NFO Beats Traditional Options

| Instrument | Avg. Return | Liquidity | Tax Efficiency |

|---|---|---|---|

| Savings Account | 3-4% | Instant | Low |

| Fixed Deposit | 6-7% | Lock-in Period | Medium |

| Jio-BlackRock Liquid Fund | 6-7.5% | T+1 | High (Indexation benefit) |

*Post-tax returns after 3 years: Liquid funds outperform FDs by 1-2% via indexation.*

Conclusion: Should You Invest?

The Jio BlackRock Liquid Fund NFO (June 30 – July 14) is a historic entry point into a fusion of global expertise and digital agility. For short-term goals or parking emergency funds, it offers superior liquidity and safety than FDs. As this partnership unfolds, expect revolutionary, low-cost products that leverage India’s digital infrastructure.

Final Verdict: Ideal for first-time investors and liquidity seekers. Monitor future equity funds for long-term wealth creation.

FAQs: Quick Answers

- Can I redeem anytime?

Yes! Liquid funds allow withdrawals within 24 hours. - Is there a lock-in period?

None. Enjoy complete liquidity. - How is this different from Jio’s existing apps?

This is a SEBI-regulated mutual fund – not a wallet or UPI service. - Will BlackRock’s global funds be available?

Eventually yes, but initial products are India-focused. - Where to track NAV?

On Jio Financial Services app, BlackRock India, or AMFI.